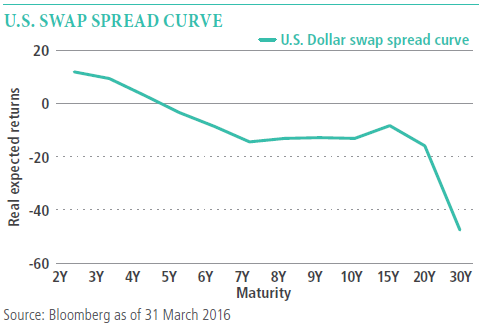

Covered Interest Rate Parity Lost: Understanding the Cross-Currency Basis | AnalystPrep - FRM Part 2 Study Notes

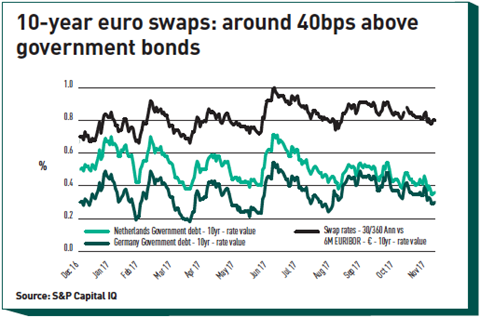

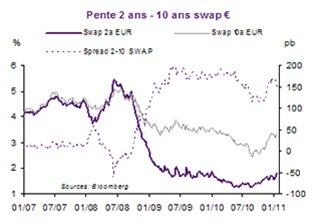

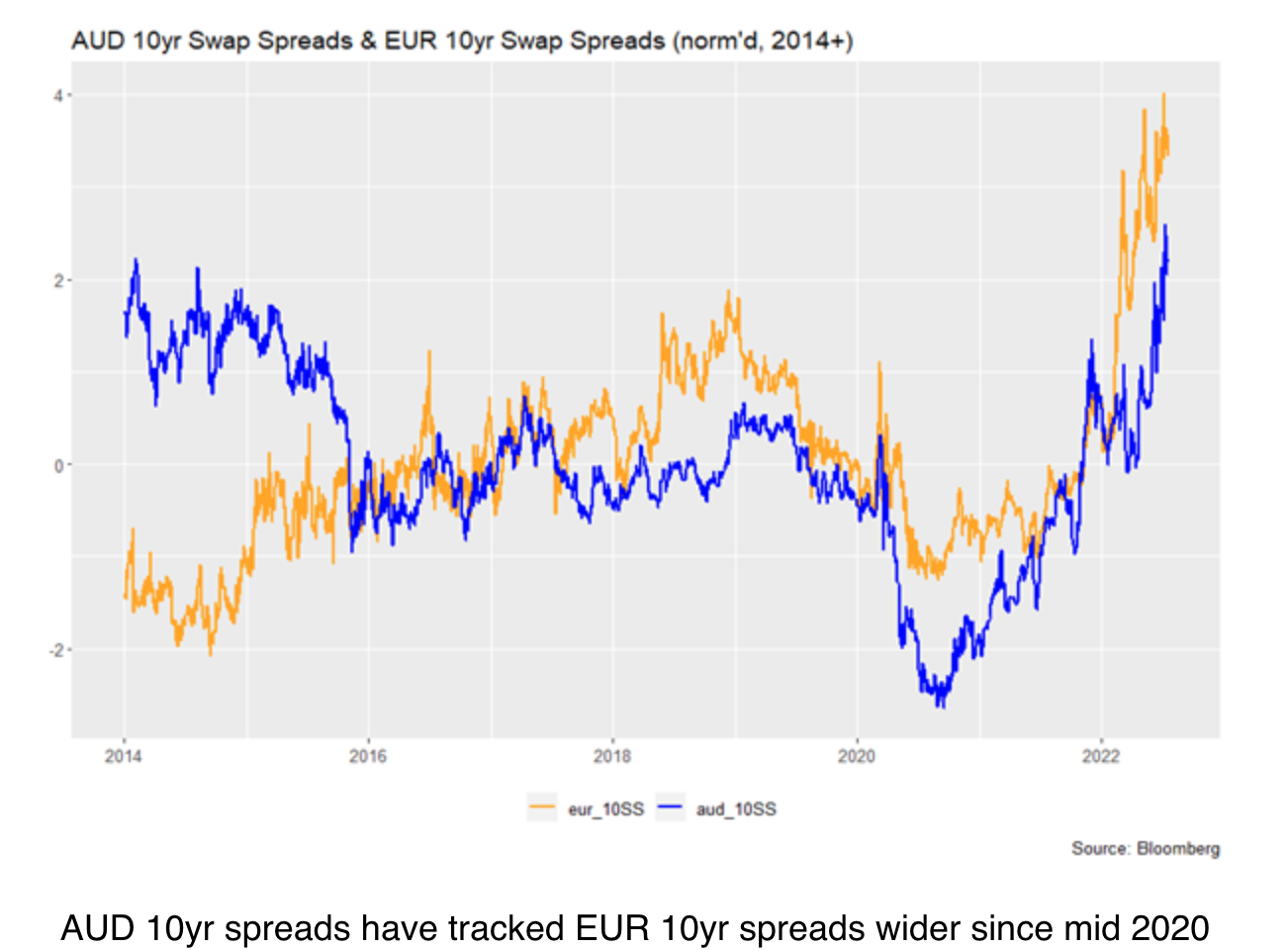

Le thème de la semaine : Une analyse de la hausse des swap spreads La revue des marchés : BCE : l'heure de vérité. Le grap

Fixed Income: Roche emittiert EUR Benchmark-Anleihe mit Laufzeiten von 6,5 Jahren (Mid Swap +45 bp) und 12 Jahren (Mid Swap +60-65 bp)

Fixed Income: Kering emittiert EUR Benchmark-Anleihe mit Laufzeiten von 6 Jahren (Mid Swap +40-45 bp) und 10 Jahren (Mid Swap +70 bp)

![Planters + Clipping Swap [Mid-City] – POT Planters + Clipping Swap [Mid-City] – POT](http://www.potstudiola.com/cdn/shop/files/Planters_ClippingSwap-1_26c9de17-ef69-456d-90d4-95d642a8919b.jpg?v=1687307155)